|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

Understanding Credit Repair Agencies: Navigating the Path to Financial Health

Amidst this financial landscape, credit repair agencies emerge as entities claiming to offer solutions for individuals seeking to improve their credit scores, often misunderstood yet indispensable to many. But what exactly do these agencies do, and are they worth the investment?

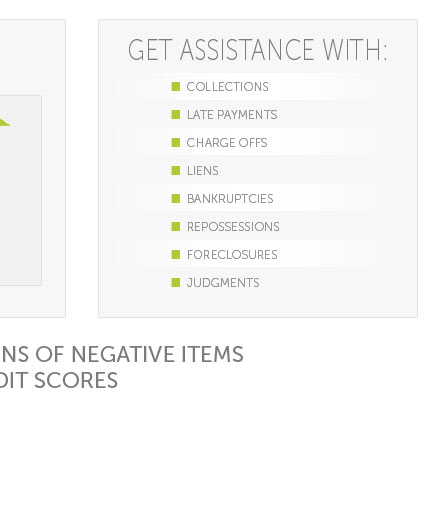

At their core, credit repair agencies specialize in identifying and addressing inaccuracies in a person's credit report. These agencies work on behalf of clients to dispute errors with credit bureaus, negotiate with creditors, and provide advice on managing one's credit profile more effectively. While anyone can technically dispute inaccuracies themselves, the process can be tedious and time-consuming, requiring a thorough understanding of consumer protection laws such as the Fair Credit Reporting Act (FCRA).

One might wonder, however, whether engaging such services is necessary. Indeed, the decision largely depends on individual circumstances. For those lacking the time or expertise to manage credit disputes independently, a credit repair agency can be a valuable ally. Yet, it's essential to approach these services with caution, as the industry has its share of unscrupulous operators. It's crucial to research thoroughly, looking for agencies with a proven track record and transparent practices.

Critics of credit repair agencies often point to the fact that they cannot do anything that an individual cannot do on their own, and while this is technically true, it's akin to saying that you can perform your own legal work or taxes without professional help. The value lies not just in the actions taken, but in the expertise and efficiency with which they are carried out. Moreover, reputable credit repair companies often provide educational resources to help clients maintain good credit habits, ensuring long-term improvements rather than quick fixes.

- Cost Considerations: Credit repair services are not free, and costs can vary widely. Potential clients should weigh these costs against the potential financial benefits of an improved credit score.

- Legal Protections: Consumers are protected under laws like the Credit Repair Organizations Act (CROA), which prohibits misleading claims and ensures clients have certain rights.

- Time Frame: Repairing credit is not instantaneous; it requires patience. Legitimate agencies will provide realistic timelines and avoid guaranteeing specific outcomes.

In conclusion, while credit repair agencies offer a pathway to potentially improve one's financial standing, they are not a panacea for all credit woes. They require a careful evaluation of potential benefits against costs and a keen eye for legitimate practices. For those who navigate this space judiciously, these agencies can indeed be a worthwhile consideration in the broader strategy of financial health and sustainability.

Lexington Law Firm advocates for you, using powerful legal strategies to fight the injustice in your credit reports.

Credit repair companies claiming to erase credit problems, remove situations like bankruptcies from your credit reports, or create a new credit identity for ...

CNBC Select rounds up the top five credit repair companies based on fees, customer satisfaction ratings, company history, availability and money-back ...